In the period of 2021 - 2025, with drastic direction, flexible, transparent, economical and effective management, the province's State budget revenue achieved an impressive figure, nearly 2.38 times higher than that of the period of 2016 - 2020. Thereby, the province's economy maintained an average growth rate of 9.17%/year, contributing to the completion of the set socio-economic development targets and tasks....

Production activities at Do Luong Joint Stock Company, Do Luong Industrial Park.

In recent years, along with the whole country, the province has faced many difficulties and challenges due to the impact of the world economic situation, epidemics, and businesses have not fully recovered production and business activities...

That reality has caused many disadvantages in budget collection. In order to complete and exceed the set budget revenue, the Provincial Budget Collection Steering Committee always innovates in directing and managing budgetary finances; evaluates monthly, quarterly and annual performance results, grasps difficulties and obstacles, and proposes solutions to promptly resolve them, especially for key enterprises.

Implementing thorough decentralization and delegation of authority in budget revenue and expenditure, ensuring the principle that the provincial budget plays a leading role; tightening financial and budgetary discipline, nurturing revenue sources and facilitating the development of production, business, import and export. Comrade Nguyen Duc Son, Head of the Provincial Tax Department, said: Every year, the Tax Department, based on the assigned budget, resolutely implements tax collection solutions, ensuring correct and full collection. In particular, focusing on promoting digital transformation with a modern tax management system, increasing the application of electronic tax services to create the most favorable conditions for both tax officers and taxpayers; regularly training on tax policies, especially new tax policies for tax officers and taxpayers. Organizing inspections and checks to promptly correct violations in tax obligations, better exploiting potential revenue sources...

Tax officers at the 7th base guide business households to install the eTax Mobile electronic tax application on smartphones.

Therefore, in the period of 2021 - 2025, the province has the highest domestic revenue ever, especially in 2025, the National Assembly and the Government assigned the province to collect 50,006 billion VND, an increase of 10.8% compared to 2024, but after only 8 months, the province has achieved 63,078 billion VND, equal to 126.1% of the estimate, an increase of 93.3% compared to the same period in 2024.

Thanks to the proactive management and operation of the province's budget, the active participation of the entire political system, the correct and accurate advice and methodical implementation of the Finance and Tax sectors, the budget collection results in recent years have increased remarkably and sustainably, ensuring to meet the spending tasks to implement the socio-economic development goals of the province. The achieved figures are very impressive with the total state budget revenue of the province in the 2021 - 2025 period estimated at 269,993 billion VND, nearly 2.38 times higher than in the 2016 - 2020 period. In 2025 alone, the province's state budget revenue is estimated at 74,432 billion VND, far exceeding the set target.

Comrade Nguyen Duc Tai, Director of the Department of Finance, affirmed: The province's state budget revenue increased sharply, both from land use fees due to the promotion of urbanization and from production and business. The revenue structure changed in a more positive and sustainable direction; revenue sources and revenue bases expanded; revenues from taxes, fees, and charges all grew; domestic revenue excluding land use fees increased compared to the previous period and exceeded the annual plan.

Thanks to increased revenue and savings in expenditure, the province has the conditions to invest in socio-economic development, implement the new rural construction program, ensure social security and deploy a series of key projects and works to create highlights and driving forces for growth. The province's medium-term public investment plan for the 2021 - 2025 period has been adjusted to increase many times, reaching a total public investment capital of VND 152,155 billion, the largest level ever and 3.92 times higher than the period 2016 - 2020. Total social investment capital for the 2021 - 2025 period is estimated at VND 636,304 billion, 1.67 times higher than the period 2016 - 2020.

Fabric dyeing machine control system of Bangjie Knitting Company Limited Vietnam, Pho Noi Textile Industrial Park.

In the remaining time in 2025 and the following years, the province identifies budget revenue as a key task, continues to synchronously implement solutions to increase revenue to meet expenditure tasks; ensures correct, sufficient and timely collection of revenues, expands revenue sources from taxes and fees on the basis of production and business development, gradually reduces the proportion of unsustainable revenue sources, especially land use fees. Strengthen the implementation of tax debt collection, prevent tax losses; review and improve the decentralization of revenue sources and expenditure tasks between the provincial and commune levels, not omitting tasks, ensuring autonomy and self-responsibility of each budget level.

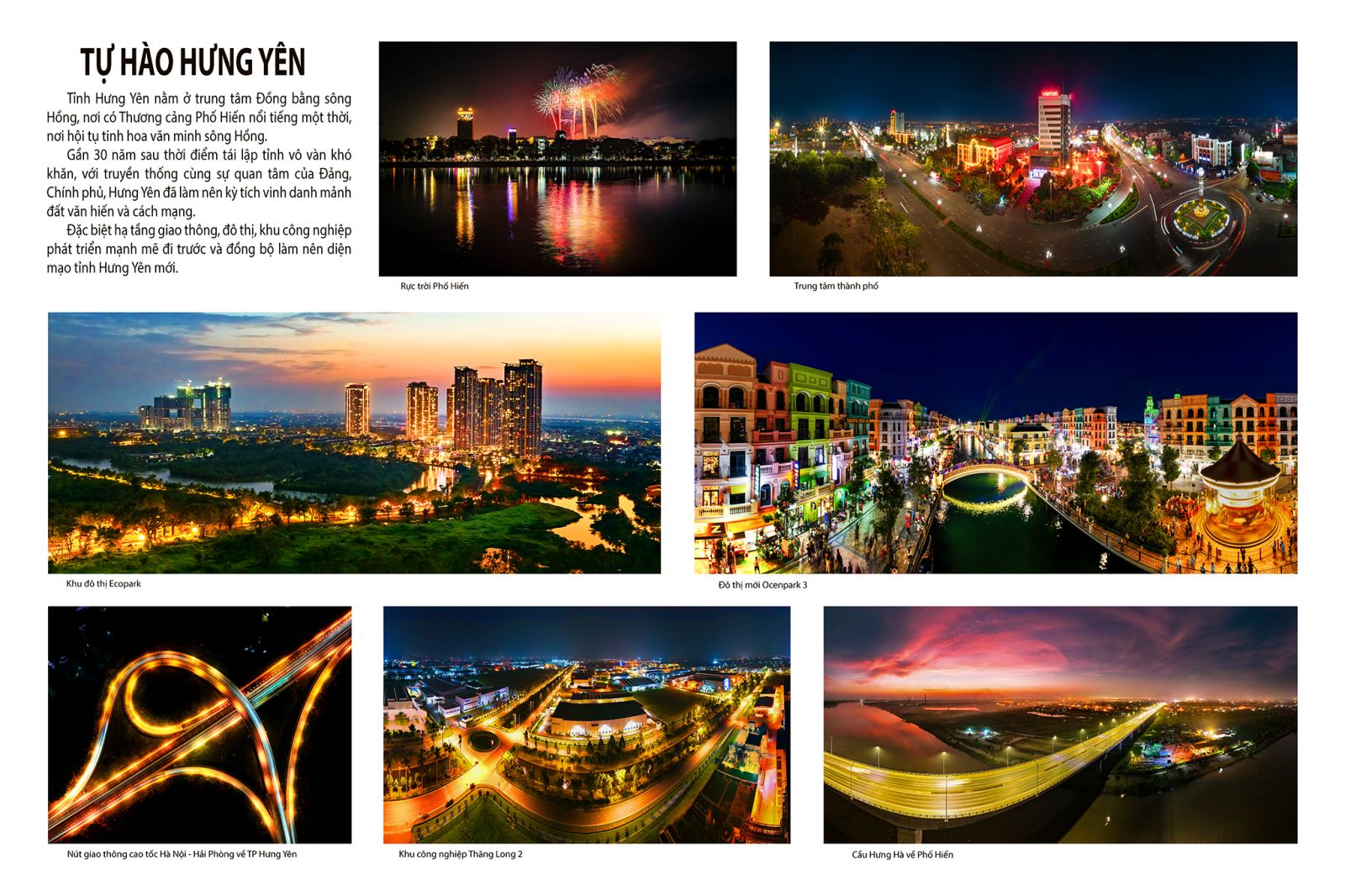

The province's overall strength has been enhanced by rapid and continuous growth, impressive results in state budget revenue and expenditure, and the synergistic values from the merger of Hung Yen and Thai Binh provinces. This is not only a testament to the outstanding efforts of the entire political system and the business community, but also a solid foundation for the province to make a strong breakthrough in the 2025 - 2030 period.

Thu Hiền

.jpg)

.jpg)

.jpg)