|

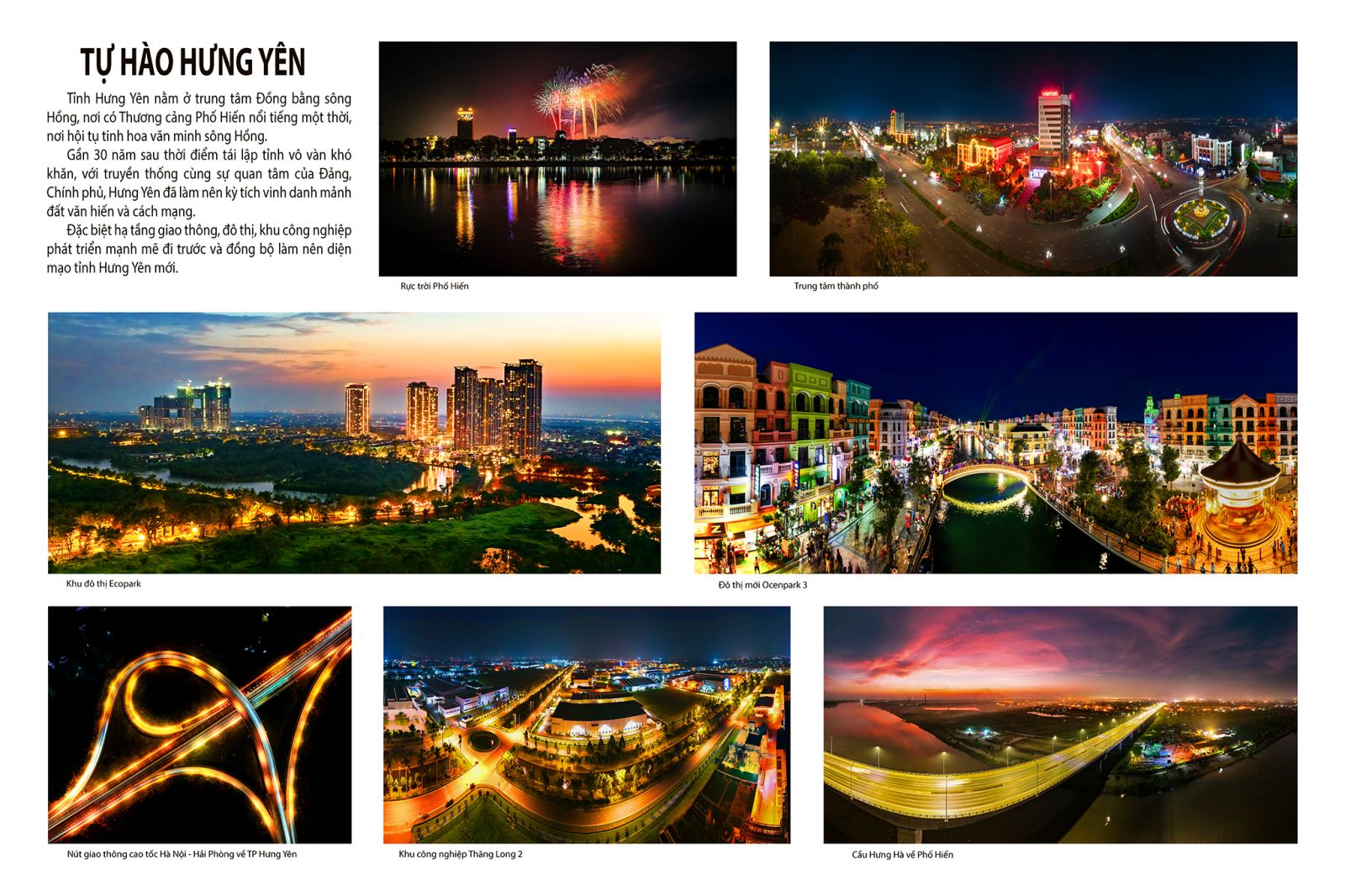

Geographical location

|

Located in Km32 National Highway 5 (Hanoi-Hai Phong); 35 km from the center of Hanoi (about 45 minutes by car); 58 km from Noi Bai International Airport (about 60 minutes by car); 65 km from Hai Phong port (about 65 minutes by car), 105 km from Quang Ninh deep water seaport (about 100 minutes by car). |

|

Location |

▪ Located in My Hao district, Hung Yen province. |

|

Planning map |

|

|

Planning area |

▪ Total planning area: 153.7 ha; ▪ Industrial land for lease: 115 ha. ▪ The remaining area for lease: 115 ha. |

|

Land rental and service charges |

▪ Estimated land rental: Approximately US $ 100 m2 per year ▪ Other fees: In line with the regulations of the IP ▪ Electricity fee: In line with the regulations of EVN. |

|

Term of land lease |

▪ Up to March 11, 2058 |

|

Field of investment attraction |

▪Manufacture and assembly of electrical, electronic and refrigeration equipment; production of paper, packaging, ceramics; processing of agro-forestry and food; production of consumer goods; light industry. |

|

Infrastructure |

The procedures of land recovery are in progress. |

|

Social infrastructure and advantages |

▪ Customs: Hung Yen customs - clearance station is located about 7 km from the IP. ▪ Bank: The system of commercial banks is located near the IP. ▪ Post office: The district post office is located about 4 km away from the IP, ready to meet the needs of enterprises in the industrial park. ▪ Hospital, clinic: My Hao district medical center (4 km from the IP), Pho Noi General Hospital (10 km from the IP). |

|

Investment incentives |

▪ Corporate income tax: - To enjoy a tax rate of 10% within 15 years and a tax exemption for 4 years, a 50% reduction of the payable tax amount for 9 subsequent years, for income from the implementation of new investment projects in a number of preferential investment fields in accordance with the law on enterprise income tax. - To enjoy a tax rate of 17% and a tax exemption for 2 years, a 50% reduction of the payable tax amount for 4 subsequent years, for income from the implementation of new investment projects in a number of fields such as high-grade steel production; production of energy-saving products; production of machinery and equipment servicing for agricultural, forestry, fishery and salt production; production of irrigation equipment; production and refining of animal feed, poultry, seafood..... - Corporate income tax is exempted for 2 years and to reduce 50% of payable tax amount for 4 subsequent years for enterprises implementing new investment projects in the IP. ▪ Import tax: Investment projects in the IP are exempted from import tax on imported goods to create fixed assets in accordance with the Law on Export and Import Duties. |

|

Investment attraction |

|

|

Investor |

▪ Investor: Vietnam Investment Development Group Joint Stock Company. - Address: No. 115, Tran Hung Dao, Hoan Kiem, Hanoi. - Tel: 84 04 37767063 - Contact person: Mr. Huan: 0989 768586. |

Nguồn trích dẫn: http://banqlkcn.hungyen.gov.vn